Many electricity Transmission and Distribution utilities use high-voltage electro-mechanical plant and switchgear containing Sulfur Hexafluoride (SF6) synthetic gas.

SF6 is used inside circuit breakers, reclosers, switchgear and wind turbines to extinguish the electrical arc when the contacts inside are separated; enabling the electrical circuit to be broken. The use of SF6 gas allows equipment to be much smaller and more efficient.

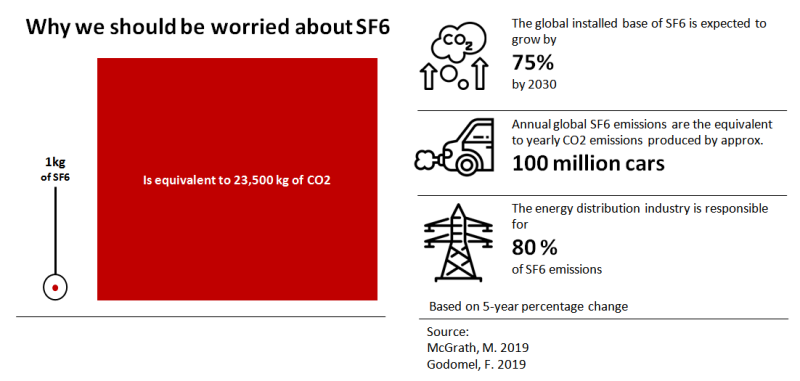

Impact of SF6

According to the Intergovernmental Panel on Climate Change, SF6 is the most potent greenhouse gas that it has evaluated, with a global warming potential of 23,900 times that of CO2 when compared over a 100-year period [1 Appendix 1]. All developed jurisdictions require the annual reporting of SF6 usage [9][10][2].

SF6 today contributes less than 1 percent of man made global warming, although is increasing annually [2].

SF6 circuit breakers typically have a combination of static seals (O-rings and gaskets) as well as dynamic seal assemblies. Over time, seals degrade due to environmental conditions and exposure.

The IEC ‘default annual leakage rates’ of SF6 for a single ‘gas insulated switchgear and circuit breaker applications’ is 0.0089 (i.e. less than 1%) [1]. Major manufacturers have demonstrated leakage rates below 0.1% per year, following decades of operational experience and extreme temperature testing [8].

‘Gas insulated switchgear and circuit breaker applications’ have a SF6 capacity ranging from 1.8 kg (for a 22kV Distribution Recloser) to 49.6 kg (for a 500kV substation circuit breaker).

Using leakage rates of 0.1%, and 2019 regional carbon prices [5] this could cost power utilities between $600 to $17k (AUD), or £1k to £35k (GBP) per circuit breaker annually. Large utilities could own hundreds (Transmission) or thousands (Distribution) of SF6 circuit breakers [9] and these costs would accumulate significantly over time.

Condition-Based Maintenance Asset Strategy

SF6 gas levels are typically recorded during routine (e.g. monthly, bi-monthly, quarterly) equipment inspections on-site.

When a trend of lowering SF6 gas pressure is observed, the cause of the leak is subsequently investigated and (hopefully) rectified per the equipment manufacturer’s instructions. Non-evasive ‘laser leak detection’ technologies can help to pinpoint the source of SF6 leaks.

from the Field (Left) to Reporting (Right)

The presence of a ‘high leakage rate alarm’ SCADA alarm may be forwarded digitally to the system operator, via the SCADA system, to trigger a medium/low priority inspection.

from the Field (Left) to Operator (Right)

At the end of life, disposal of the used SF6 gas is either recycled, or disposed by incineration.

Alternatives for SF6 are commercially available for use in electrical switchgear at low-to-medium voltages. Solutions for use at higher-voltages are more challenging, although pilot installations do exist at 145kV.

The technical life of circuit breakers and switchgear is typically around 40 years and the ongoing cost of SF6 will be a factor in planning for replacement.

This condition-based asset strategy leaves scope for SF6 to be leaked in-between routine inspections and for response to be reactive in nature, with associated environmental and financial impacts.

In the meantime, it is prudent to measure and manage SF6 gas usage with a ‘Real-Time’ condition-based maintenance strategy, and offset emissions.

‘Real-Time’ Condition-Based Maintenance Strategy

Substations and Distribution Automation equipment (particularly modern substations utilizing IEC 61850 protocols) have access to a wealth of digital data on the condition and performance of circuit breakers and switchgear.

SF6 gas pressure can be digitally monitored via (e.g. DNP3 digital inputs) alarms for ‘high leakage rate alarm’ and measurements (e.g. DNP3 analog inputs) for ‘leakage rate’; shown below. If needed, a transducer or SF6 monitor can be retrofitted to closed pressure equipment to provide the capability.

However, the Real-Time data available on-site is often aggregated or distilled for forwarding to a central location. This is often due to human or technological constraints such as:

- Limiting the information overload to the personnel administering alarms and measurements; to raise a work request or job request for remedial action

- Bandwidth limiting the volume of data transmitted

- Computational processing power limiting the volume of data collected, interpreted and forwarded

Also, in most cases the SCADA connected equipment requires human intervention (i.e. operator or asset manager) to raise a work request or job request for remedial action i.e. SCADA and/or data historian systems not integrated with Enterprise Resource Planner.

from the Field (Left) to Reporting (Right)

To enable effective analytics and decision-making will often require end-to-end re-configuration or upgrade:

- On-site product relays or controllers

- On-site substation computing such as Remote Terminal Units (RTU), gateways or regional data concentrators

- Head-end Real-Time SCADA systems such as Energy Management System, Distribution Management System

- Data-historian, data warehouse including ETL and reporting capability

- Enterprise Resource Planner (ERP) and/or Asset Management System (AMS)

- New backhaul telecommunications circuits and data center hosting capacity

An alternative, expedited approach is for SF6 monitoring and reporting via a vendor subscription (additional $/month), typically by retrofitting (and powering) the vendor’s SF6 monitor and a 3G/4G cellular modem to each circuit breaker (shown below).

from the Field (Left) to Reporting (Right)

With the new real-time information, SF6 leakage can be detected instantly and earlier than physical inspection and with data analytics unlock capabilities for preventative maintenance. This may involve identifying and reacting early to trends and correlation within different operating environments (e.g. weather, altitude), vendors, products, installation practices or workmanship.

Real-time monitoring may be a cost effective strategy to manage carbon emissions, compared to manual inspections and proactive replacement.

Change for Climate Change

An increasing environmental focus, compliance requirements and carbon markets is expected over the years to come.

Utilities and their partners that are ready and prepared to manage their SF6 emissions will benefit from avoiding the rush and actively managing the brand impact, if/when the legislative change occurs.

Any new environmental obligations and adopted carbon pricing models could provide an exemption to existing, in-service equipment, only applying to new equipment installations; subject to a grandfathered strategy to transition by a certain date (e.g. replace on failure or beyond economic repair with compliant equipment).

Or an approach could be to plant a LOT of trees or actively trade in carbon credit markets.

In most cases there is existing telemetry and operational technology capability to leverage, ask me how to improve your asset management strategy and connect your IT/OT businesses and technologies to extract these benefits and deploy at speed today.

References:

[1] https://www.industry.gov.au/sites/default/files/2020-07/national-greenhouse-accounts-factors-august-2019.pdf

[2] https://www.bbc.com/news/science-environment-49567197#:~:text=Cheap%20and%20non%2Dflammable%2C%20SF6,stations%20in%20towns%20and%20cities.

[3] https://www.clipsal.com/faq/detail?ID=FA226304

[4] https://www.epa.gov/sites/production/files/2016-02/documents/conf00_krondorfer.pdf

[5] https://carbonpricingdashboard.worldbank.org/

[6] https://www.epa.gov/sites/production/files/2016-02/documents/conf06_bessede.pdf

[7] https://1library.net/document/myjd7g2y-alternatives-to-sf-in-hv-circuit-breaker-insulation.html

[8] https://assets.new.siemens.com/siemens/assets/api/uuid:57363d51dd291bd91128dd7665ae64e808f2fdf2/high-voltage-circuit-breakers-portfolio-en.pdf

[9] https://www.aer.gov.au/system/files/PWC%20-%2014.7%20AMP%20High%20Voltage%20Circuit%20Breakers%20-%2028%20February%202018.pdf

[10] https://www.epa.gov/sites/production/files/2017-02/documents/rak_presentation_2017_workshop.pdf