In Western Australia, the Clean Energy Link is framed as a major step forward — unlocking renewable energy zones and supporting the energy transition. But look a little deeper, and important questions emerge:

Who is funding the infrastructure — and who profits from it?

Are we prioritising outcomes, or just asset growth?

Is this genuinely about decentralisation, or simply shifting control?

I recently unpacked these tensions in a long-form piece — reflecting on how state-owned infrastructure, policy narratives, and private capital are interacting in ways that deserve scrutiny.

👉 Read the full post here:

https://citizen-erased.com/clean-energy-link

The goal isn’t to be cynical — it’s to be clear-eyed. We all want a cleaner energy future. But we also need to ensure transparency, accountability, and fairness as we build it.

Would welcome your thoughts.

#energytransition #infrastructure #policy #netzero #transparency #cleanenergy

Category: Perspectives

The rise of artificial intelligence (AI) has brought significant changes to various industries, and asset investment planning and business case development are no exceptions. As AI continues to evolve, there is growing concern that it might replace jobs traditionally performed by humans in these fields. However, the reality is more nuanced. While AI has the potential to automate many tasks, the technology’s effectiveness depends on the quality of data inputs and the structure of the systems it operates within. This article explores how AI is impacting asset investment planning and business cases, what is required to make it work effectively, and the ongoing role of human expertise in managing data, asset information, and SCADA (Supervisory Control and Data Acquisition) systems as inputs.

The Potential of AI in Asset Investment Planning

AI offers several advantages in asset investment planning, particularly in areas where large amounts of data need to be analyzed and complex decisions must be made. Some key benefits include:

- Automation of Routine Tasks: AI can handle repetitive tasks such as data entry, basic financial analysis, and report generation, freeing up human resources for more strategic activities.

- Enhanced Predictive Analytics: AI algorithms can analyze historical data to forecast future trends, helping businesses make more informed decisions about asset investments.

- Improved Risk Management: By continuously monitoring various factors that influence asset performance, AI can identify potential risks early and suggest mitigation strategies.

- Optimization of Asset Portfolios: AI can evaluate and optimize asset portfolios based on predefined criteria, ensuring that investments align with the company’s overall strategy.

These capabilities make AI a powerful tool in asset investment planning, but they also raise concerns about job displacement. While some roles may be automated, the transition to AI-driven processes requires a new set of skills and expertise.

The Role of Data Entry and Structure in AI

One of the most critical factors determining AI’s success in asset investment planning is the quality and structure of the data it uses. AI systems rely on vast amounts of data to make accurate predictions and recommendations. However, the adage “garbage in, garbage out” holds true—if the input data is flawed, the AI’s outputs will be unreliable.

To ensure that AI systems function effectively, businesses must focus on:

- Data Integrity: Ensuring that all data entered into AI systems is accurate, complete, and up-to-date. This requires robust data governance practices and regular audits to catch and correct errors.

- Standardization of Data: For AI to process data efficiently, it needs to be standardized across the organization. This means establishing common formats, units of measurement, and data entry protocols.

- Data Integration: AI systems often need to pull data from multiple sources, including enterprise resource planning (ERP) systems, financial databases, and external market data feeds. Ensuring seamless integration between these sources is crucial for accurate AI analysis.

While AI can automate some aspects of data management, human oversight is essential to maintain data quality and structure. This means that jobs in data management are likely to evolve rather than disappear, with a greater focus on ensuring that AI has the right inputs to work with.

Managing Asset Information

In asset investment planning, detailed and accurate asset information is crucial. AI systems can analyze asset performance data, predict maintenance needs, and optimize investment decisions. However, managing asset information is a complex task that involves several key activities:

- Asset Lifecycle Management: Keeping track of an asset from its acquisition to its disposal, including maintenance schedules, performance metrics, and financial data.

- Condition Monitoring: Continuously monitoring the condition of assets using sensors and other technologies to predict when maintenance is needed.

- Data Accuracy: Ensuring that all asset information is accurate and up-to-date, which is critical for AI-driven decision-making.

AI can assist in managing asset information by automating data collection and analysis, but human expertise is still needed to interpret the results and make strategic decisions. For example, while AI can predict when an asset might fail, human engineers are often required to validate these predictions and decide on the best course of action.

The Importance of SCADA Systems

SCADA systems play a vital role in asset investment planning, particularly in industries such as utilities, manufacturing, and transportation. These systems collect real-time data from assets and infrastructure, providing valuable inputs for AI analysis.

However, the integration of SCADA systems with AI requires careful planning and management:

- Data Collection: SCADA systems generate vast amounts of data, which can be overwhelming without proper filtering and processing. AI can help by identifying the most relevant data points for analysis.

- Real-Time Monitoring: AI can analyze SCADA data in real-time, allowing for immediate responses to issues such as equipment failures or safety hazards.

- Predictive Maintenance: By analyzing SCADA data, AI can predict when equipment is likely to fail and recommend maintenance before a breakdown occurs.

While AI can enhance the capabilities of SCADA systems, human operators are still needed to oversee the process and ensure that the AI’s recommendations are implemented correctly. Additionally, the design and maintenance of SCADA systems themselves remain critical tasks that require specialized skills.

The Ongoing Role of Human Expertise

Despite the potential for AI to automate many tasks in asset investment planning and business case development, human expertise remains essential. AI systems are tools that require proper setup, management, and interpretation to be effective. The following areas will continue to require human involvement:

- Strategic Decision-Making: While AI can provide data-driven insights, the final decision on asset investments and business cases will likely remain in the hands of human managers, who can weigh factors such as company culture, market conditions, and ethical considerations.

- Oversight and Validation: AI systems need to be regularly monitored to ensure they are functioning correctly. Human oversight is crucial to catch any errors or biases in the AI’s outputs and to adjust the system as needed.

- Data Management: As mentioned earlier, maintaining data quality and structure is critical for AI to function effectively. This requires ongoing human effort to manage and clean data, ensure standardization, and integrate different data sources.

- SCADA and Asset Information Management: The management of SCADA systems and asset information will continue to be a vital role, requiring both technical expertise and strategic insight.

AI is poised to significantly impact asset investment planning and business cases, automating routine tasks, enhancing predictive analytics, and improving risk management. However, its effectiveness depends on the quality of data inputs, the structure of data management systems, and the integration of SCADA and asset information.

Rather than replacing human jobs entirely, AI is likely to change the nature of work in these fields, with a greater emphasis on data management, system oversight, and strategic decision-making. For businesses to fully realize the benefits of AI, they must invest in the right tools, train their workforce to manage and interpret AI outputs, and ensure that their data is accurate, standardized, and well-integrated.

The future of asset investment planning and business case development will be a collaboration between AI and human expertise, each playing a crucial role in driving better outcomes for businesses.

Many electricity Transmission and Distribution utilities use high-voltage electro-mechanical plant and switchgear containing Sulfur Hexafluoride (SF6) synthetic gas.

SF6 is used inside circuit breakers, reclosers, switchgear and wind turbines to extinguish the electrical arc when the contacts inside are separated; enabling the electrical circuit to be broken. The use of SF6 gas allows equipment to be much smaller and more efficient.

Impact of SF6

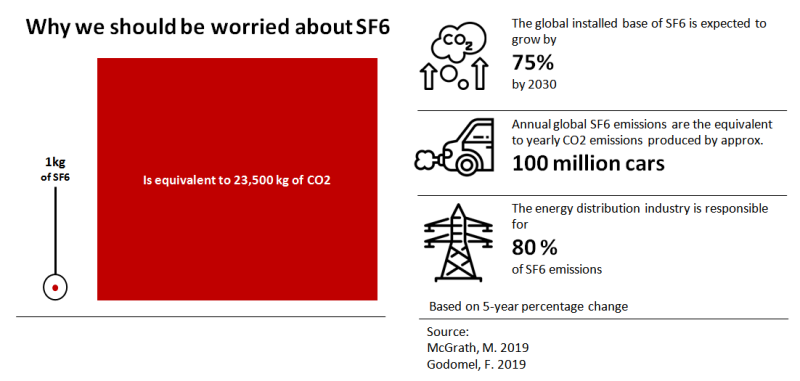

According to the Intergovernmental Panel on Climate Change, SF6 is the most potent greenhouse gas that it has evaluated, with a global warming potential of 23,900 times that of CO2 when compared over a 100-year period [1 Appendix 1]. All developed jurisdictions require the annual reporting of SF6 usage [9][10][2].

SF6 today contributes less than 1 percent of man made global warming, although is increasing annually [2].

SF6 circuit breakers typically have a combination of static seals (O-rings and gaskets) as well as dynamic seal assemblies. Over time, seals degrade due to environmental conditions and exposure.

The IEC ‘default annual leakage rates’ of SF6 for a single ‘gas insulated switchgear and circuit breaker applications’ is 0.0089 (i.e. less than 1%) [1]. Major manufacturers have demonstrated leakage rates below 0.1% per year, following decades of operational experience and extreme temperature testing [8].

‘Gas insulated switchgear and circuit breaker applications’ have a SF6 capacity ranging from 1.8 kg (for a 22kV Distribution Recloser) to 49.6 kg (for a 500kV substation circuit breaker).

Using leakage rates of 0.1%, and 2019 regional carbon prices [5] this could cost power utilities between $600 to $17k (AUD), or £1k to £35k (GBP) per circuit breaker annually. Large utilities could own hundreds (Transmission) or thousands (Distribution) of SF6 circuit breakers [9] and these costs would accumulate significantly over time.

Condition-Based Maintenance Asset Strategy

SF6 gas levels are typically recorded during routine (e.g. monthly, bi-monthly, quarterly) equipment inspections on-site.

When a trend of lowering SF6 gas pressure is observed, the cause of the leak is subsequently investigated and (hopefully) rectified per the equipment manufacturer’s instructions. Non-evasive ‘laser leak detection’ technologies can help to pinpoint the source of SF6 leaks.

from the Field (Left) to Reporting (Right)

The presence of a ‘high leakage rate alarm’ SCADA alarm may be forwarded digitally to the system operator, via the SCADA system, to trigger a medium/low priority inspection.

from the Field (Left) to Operator (Right)

At the end of life, disposal of the used SF6 gas is either recycled, or disposed by incineration.

Alternatives for SF6 are commercially available for use in electrical switchgear at low-to-medium voltages. Solutions for use at higher-voltages are more challenging, although pilot installations do exist at 145kV.

The technical life of circuit breakers and switchgear is typically around 40 years and the ongoing cost of SF6 will be a factor in planning for replacement.

This condition-based asset strategy leaves scope for SF6 to be leaked in-between routine inspections and for response to be reactive in nature, with associated environmental and financial impacts.

In the meantime, it is prudent to measure and manage SF6 gas usage with a ‘Real-Time’ condition-based maintenance strategy, and offset emissions.

‘Real-Time’ Condition-Based Maintenance Strategy

Substations and Distribution Automation equipment (particularly modern substations utilizing IEC 61850 protocols) have access to a wealth of digital data on the condition and performance of circuit breakers and switchgear.

SF6 gas pressure can be digitally monitored via (e.g. DNP3 digital inputs) alarms for ‘high leakage rate alarm’ and measurements (e.g. DNP3 analog inputs) for ‘leakage rate’; shown below. If needed, a transducer or SF6 monitor can be retrofitted to closed pressure equipment to provide the capability.

However, the Real-Time data available on-site is often aggregated or distilled for forwarding to a central location. This is often due to human or technological constraints such as:

- Limiting the information overload to the personnel administering alarms and measurements; to raise a work request or job request for remedial action

- Bandwidth limiting the volume of data transmitted

- Computational processing power limiting the volume of data collected, interpreted and forwarded

Also, in most cases the SCADA connected equipment requires human intervention (i.e. operator or asset manager) to raise a work request or job request for remedial action i.e. SCADA and/or data historian systems not integrated with Enterprise Resource Planner.

from the Field (Left) to Reporting (Right)

To enable effective analytics and decision-making will often require end-to-end re-configuration or upgrade:

- On-site product relays or controllers

- On-site substation computing such as Remote Terminal Units (RTU), gateways or regional data concentrators

- Head-end Real-Time SCADA systems such as Energy Management System, Distribution Management System

- Data-historian, data warehouse including ETL and reporting capability

- Enterprise Resource Planner (ERP) and/or Asset Management System (AMS)

- New backhaul telecommunications circuits and data center hosting capacity

An alternative, expedited approach is for SF6 monitoring and reporting via a vendor subscription (additional $/month), typically by retrofitting (and powering) the vendor’s SF6 monitor and a 3G/4G cellular modem to each circuit breaker (shown below).

from the Field (Left) to Reporting (Right)

With the new real-time information, SF6 leakage can be detected instantly and earlier than physical inspection and with data analytics unlock capabilities for preventative maintenance. This may involve identifying and reacting early to trends and correlation within different operating environments (e.g. weather, altitude), vendors, products, installation practices or workmanship.

Real-time monitoring may be a cost effective strategy to manage carbon emissions, compared to manual inspections and proactive replacement.

Change for Climate Change

An increasing environmental focus, compliance requirements and carbon markets is expected over the years to come.

Utilities and their partners that are ready and prepared to manage their SF6 emissions will benefit from avoiding the rush and actively managing the brand impact, if/when the legislative change occurs.

Any new environmental obligations and adopted carbon pricing models could provide an exemption to existing, in-service equipment, only applying to new equipment installations; subject to a grandfathered strategy to transition by a certain date (e.g. replace on failure or beyond economic repair with compliant equipment).

Or an approach could be to plant a LOT of trees or actively trade in carbon credit markets.

In most cases there is existing telemetry and operational technology capability to leverage, ask me how to improve your asset management strategy and connect your IT/OT businesses and technologies to extract these benefits and deploy at speed today.

References:

[1] https://www.industry.gov.au/sites/default/files/2020-07/national-greenhouse-accounts-factors-august-2019.pdf

[2] https://www.bbc.com/news/science-environment-49567197#:~:text=Cheap%20and%20non%2Dflammable%2C%20SF6,stations%20in%20towns%20and%20cities.

[3] https://www.clipsal.com/faq/detail?ID=FA226304

[4] https://www.epa.gov/sites/production/files/2016-02/documents/conf00_krondorfer.pdf

[5] https://carbonpricingdashboard.worldbank.org/

[6] https://www.epa.gov/sites/production/files/2016-02/documents/conf06_bessede.pdf

[7] https://1library.net/document/myjd7g2y-alternatives-to-sf-in-hv-circuit-breaker-insulation.html

[8] https://assets.new.siemens.com/siemens/assets/api/uuid:57363d51dd291bd91128dd7665ae64e808f2fdf2/high-voltage-circuit-breakers-portfolio-en.pdf

[9] https://www.aer.gov.au/system/files/PWC%20-%2014.7%20AMP%20High%20Voltage%20Circuit%20Breakers%20-%2028%20February%202018.pdf

[10] https://www.epa.gov/sites/production/files/2017-02/documents/rak_presentation_2017_workshop.pdf

A pipe dream years ago, ‘Private LTE’ is growing in utility circles and a buzz at the #Distributech conference I attended in February 2019.

Utilities have a range of current and emerging use cases and smart grid applications to meet customer service objectives and to remain relevant with new services.

These needs are currently enabled by ‘stacking’ private, proprietary narrowband wireless networks for priority ‘mission critical’ voice and data services, and complementing with commercial telecommunications carrier services.

If all of these services are aggregated, including Push-to-Talk’ voice and smart metering, an upgradable industry-standard wireless broadband solution can meet the needs of tomorrow.

The solution would be designed and operated to meet the reliability and security requirements of the most demanding ‘mission critical’ utility use cases.

However, this is contingent on access to valuable spectrum.

US emergency services with similar ‘mission critical’ reliability and security needs are migrating to ‘FirstNet’ mobile broadband, on federal provision of 700 MHz spectrum.

Investor-owned Utilities (IOU) do not (and in my opinion should not) have such a luxury.

Licensed spectrum can be acquired in competition with telcos; an expensive proposition. As such, the telecommunications industry has progressed technology to manage the precious spectrum asset including roaming, carrier aggregation, network slicing, spectrum arbitrage, prioritization, preemption and Virtual Network Operator (VNO).

Any IOU submission to a regulator for capital recovery for a broadband spectrum and network is likely (and rightly so) to raise red flags.

Forward-thinking utilities can demonstrate prudency and sweeten the deal by bringing telcos millions of subscribers and offsetting the cost by bartering access to their valuable Transmission and Distribution assets: overhead structures, conduit, easements and land.

To summarize, is there a telecommunications platform available to enable the smart grid?

- Yes! Access to a industry-standard wireless, mobile broadband technology can meet all utility requirements

- Yes! The telecommunications solution can be designed to meet stringent ‘mission critical’ reliability and security needs, while sharing valuable spectrum

- Yes! With collaboration, asset arbitrage and/or recycling, broadband solutions and services can be accessed at a lower TCO (compared to today’s suite)

- But no, the ownership model does not need to be private.

And this, for utilities, will be a new world of IT/OT convergence….

Service management rather than asset management!

Please leave a comment, share or connect, I’d be interested in your thoughts.

I recently visited the “PowerBank” community battery energy storage trial in the sprawling residential suburbs of Meadow Springs and Port Kennedy in Perth, Western Australia. Both of these suburbs are ranked in the top 30 suburbs in Western Australia for rooftop solar uptake [1].

WA has embraced Distributed Energy Resources (DER) with one in three households in the South West Integrated System now generating their own renewable power with photovoltaic (PV) solar panels and growing at around 2,000 households a month.

These suburbs have experienced continued growth and is peak demand is encroaching on network capacity limits. To date, capacity constraints have been mitigated through load transfers between distribution substations [2]. Despite the high penetration of PV, the distributed generation contributes minimal demand reduction at time of substation peak load in the early evening (i.e. the “duck curve” 🦆). The 2021 forecast distribution network capacity of the region is shown below [3].

Technological developments in energy storage provide a new utility-grade solution to manage the power distribution and flatten the load profile (i.e. 🦆🔨):

- Peak Shaving: Discharge at times of peak demand to avoid or reduce demand.

- Load Shifting: Shift energy consumption from one point in time to another.

- Demand Response: Discharge instantly in response to signals from a demand response aggregator to alleviate peaks in system load.

- Emergency Backup: Provide intermediate backup power in the event of a supply interruption.

Community energy storage deployment has been green-lighted in WA with the Electricity Industry Amendment Bill 2019 [4] and the release of the Distributed Energy Resources Roadmap [5] in April 2020. The DER Roadmap recommends to install community batteries in locations that are most in need of power balancing.

The PowerBank community battery is an Australian-first trial to integrate bulk solar battery storage into the existing grid that also provides customers with a retail storage option [6].

The local customers don’t have to purchase a behind-the-meter battery, as the local Distribution utility, owns and operates a Tesla branded PowerPack standing proudly in the local park and is featured on their recent advertising campaigns.

Tesla’s PowerPack is commercially available modular battery bank for utility and business energy storage. Each 232 kWh Powerpack is a DC energy storage device containing 16 individual battery pods, a thermal control system and sensors to monitor and report on cell level performance [7].

The PowerBank trial has installed two modules (@ 232 kWh each) and is able to virtually store up to 8 kWh a day of excess generation for 50 trial subscribers (approx 464 / 8).

Although I anticipate this trial will not be operated islanded from the power network, assuming each customers consumption is 2 kWh, these 50 subscribers could potentially ride through an outage up to 5 hours (approx. 464 / 50 / 2).

Standing next to the install there was limited buzzing noise, but as a large white box within a community park, one flagship site has already been a target for vandals 😕.

I’ve been unable to source budgets or project costs for the trial. The Telsla PowerPack costs in the region of USD $172k for a 232 kWh unit [8]. The installation also requires foundations, trenching, low voltage cabling, terminations, protection or fusing, and… reconfiguration of the park’s irrigation system plus graffiti cleanup. I’d anticipate a commissioned site to manage the load profile of 50 customers may cost up to AUD 500k.

Tesla provide a 15-year “no defect” and “energy retention” warranty for the Powerpack. Tesla guarantee that the energy capacity will be at least a percentage (within a range up to 80%) of its nameplate capacity during specified time periods, depending on the product, battery pack size and/or region of installation, subject to use restrictions or kWh throughput caps. Tesla also offer extended warranties, such as 10 or 20 year performance guarantees [9].

The PowerPack utilizes the Tesla’s Microgrid Control System application available across their product range. The application provides a range of alarms and system status parameters required to operate the energy storage system with a shiny user interface [10].

Although it appears limited in Real-Time information for asset management of the battery cells such as cell degradation and capacity. IT/OT convergence is coming for power electronics! In that, rather than the use of an infrastructure asset management framework (such as ISO 55000) and internal operations, the mindset shifts to managing service and performance through warranty and support agreements.

Once (“partnered”) within the Tesla ecosystem, the Microgrid application can be scaled to other energy use cases such as distributed generation and electric vehicles.

The PowerPack provides an Ethernet port for access to Modbus TCP/IP and DNP3 protocols and Rest API [12]. This would provide interface to Tesla’s application or the Distribution utilities Distribution Management System or Distribution Energy Resource Management System (DERMS).

There was no visible antenna mounting to provide strong connectivity. I presume there is a 4G modem providing remote SCADA (and configuration access, firmware updates etc) within the kiosk. The connectivity will be valuable as it also appears there was no SCADA connectivity on the upstream transformer, distribution frame or ring main unit. At both sites there was 2 bars (-113 dBm) of 4G signal using the commercial Telstra mobile network.

If and when the community storage is deployed at scale, and under all operating conditions (incl. black start), combined with electric vehicle charging stations and distribution market operator (or virtual power plant) use cases, the control systems and telecommunications requirements are required to also scale.

Energy storage provides a new solution to manage the load profile where customers are both consuming (demand) and generating (supply). The application of energy storage technology such as a community storage on the low voltage distribution network is helpful to evaluate the solution to reduce energy costs and carbon footprint. This trial will inform technical and economical evaluations, and also facilitate regulatory, governance and operational integration.

References:

[1] https://westernpower.com.au/community/news-opinion/who-really-is-number-1-for-pv-in-perth/

[5] https://www.wa.gov.au/government/distributed-energy-resources-roadmap

[7] https://www.tesla.com/en_AU/powerpack

[8] https://electrek.co/2020/03/31/tesla-powerpack-price-commercial-solar/

[9] https://ir.tesla.com/node/20456/html

[10] https://www.gemenergy.com.au/wp-content/uploads/2017/11/Powerpack_Microgrid-System-Brochure.pdf

A2A Industry Perspectives (IP) provides content across all stages of strategy development:

- Policy

- Objectives

- Current State

- Risk Assessment

- Vision

- Strategy

- Goals

- Implementation Plan

Today I attended the Utilitydive webinar “How Utilities Can Better Manage Grid Modernization” hosted by West Monroe Partners; generally informative and underpinned by a great survey and case for change report “Managing Grid Modernization: Integrating IT and Operations at U.S. Utilities”.

A copy of the report is available here (in exchange for your marketing details).

And really, it’s presentations and information like this that have inspired A2A – utility operations are typically risk adverse, silo’d, disengaged, archaic and continually distracted with emergency response and regulatory requests; yet there is a human desire for modernization and associated buzzwords, but thought to be achieved by propagating the existing process, skillsets, cultures and technologies.

In today’s utilities, Information Technology and HR has likely been mostly outsourced; Operational Technology (OT) is held tightly by engineering and operations – as it is seen as ‘black magic’ by much of the business and the source of cautious advancement for the technical workforce; where much of the innovation is obtained by purchasing a vendors proprietary technology, islanded and ‘air-gapped’ from other systems, for security of course.

As shown in the West Monroe report, there really is a gap in industry for OT professionals, let alone IT/OT experts, and a lack of practical information, advice and OT leadership to make it happen properly:

- Process (ie workflow, re-org, roles and responsibilities)

- Systems (ie architecture, partnerships, deliberate investment)

- People (ie redeploy, purge, upskill, recruit).

For more information and perspectives, have a browse through A2A, reach out and connect.

High winds and rain across New England sees hundreds of thousands of premises without power, flooding and trees across roads. This is the second Nor’easter this winter, following the #bombcyclone in January 2018.

Power utilities and their contractors have working admirably in tough conditions to restore power and support the community.

But really, in today’s day and age, in one of the most populous and modern corners of a western nation – is this acceptable?

Many social media posts from the community would suggest not, so either the power systems are not engineered or operated to meet expectations of users or the environment has changed.

- Poles are seemingly overloaded, snapped halfway up

- Overhead lines through populous and tree lined areas

- Ageing underground cables and joints

- Americas infrastructure rated as C- by IEEE

But hey – the mass media was kind and the shareholder will profit, so all good?! /cynic

Many business cases for Grid Modernization (formerly known as Smart Grid) have focused on the technology and the direct and indirect benefits, generally a long bullet point list which sounds good, but is not usually presented as a compelling argument focused on outcomes.

The following contains a storyboard to use to develop a compelling Grid Modernization business case.

Context

The Distribution System Operator (DSO) is traditionally a monopoly with only one way for customers to access a reliable supply – the electricity network. Both customer behaviour and the regulated revenue stream were dependable and predictable.

However, the industry is experiencing increasing:

- total energy consumption

- regulatory scrutiny and WACC pressure

- customer price sensitivity

- accessibility of technological disruption and change (distributed energy generation, storage and vehicles) and;

- changing customer behaviour (participation in energy markets)

Disruptive technology

- Distributed generation

- reduced total demand

- maintain investment for peak demand

- increase investment for power quality management and protection

- Energy storage

- potential reduced customers

- reduced total demand as generating customers will store and consume rather than export

- increase investment for power quality management and protection

- Electric vehicles

- transient load / demand (peakier peak)

- maintain investment for peak demand

- increase investment for power quality management and protection

Enterprise Risk

For the DSO, adoption and proliferation of these disruptive technologies will lead to:

- an under-utilised or orphaned asset

- ongoing interest repayments for sunk capital investment

- potentially operating costs > regulated revenue

- reduced regulated revenue

- perceived barriers to changing customer behaviour and risk to current and projected regulated asset base

Objective

The objective is to:

- maintain a safe and reliable energy transport service at the lowest price (and increase shareholder Return on Investment).

AND/OR

- provide new services at the lowest price (and increase shareholder Return on Investment) such as distribution system operations (frequency control, load balancing), telecommunications or services

Asset Management Strategy

To meet the objective by investing in the minimum required asset to meet forecast demand, safety and service standards and increase existing asset utilisation (i.e. balance supply / load, smooth profile).

- Maintain network assets risk to ‘as low as reasonably practicable’

- Operational asset management

- Digital transformation / operational technology

- Influence customer behaviour

- Time of use tariff

- Demand management

- Seek alternative arrangements with customers (encourage distributed generation and energy storage)

- Improve network flexibility

- Increase application of advanced monitoring, interconnection, protection, automation and control systems

- Increase access to dispatchable energy storage

- Actively pursue alternative unregulated revenue streams i.e. telecomms, EPCM services, gas/water merger/acquisition

This is to be supported by ongoing corporate and asset strategies for continuous improvement (improve productivity / efficiency).

I’ll be presenting “Considerations in Developing an Operations Telecommunications Strategy” at the Burns & McDonnell Next Practices Forum in April 2018 in Denver ,CO.

I’ve been refreshing the private telecommunications network strategy for New England’s largest Investor Owned Utility, and is developing a holistic approach to guide telecommunications investment through to 2027.

The private telecommunications infrastructure consists of Wide Area Network (WAN) and Field Area Network (FAN) systems used to safely, reliably, and efficiently execute complex business operations.

My approach to telecommunications strategy development is pragmatic and provides consideration of possible business models, technology, and operating frameworks, including collaboration with Burns & McDonnell to evaluate investments including fiber optic and wireless network deployments.

In this presentation, I’ll discuss considerations and methodology to develop a compelling strategy including evaluating the current environment, developing a vision, and analyzing options to direct future investment and operations.

Register for the Burns & McDonnell Next Practices Forum here.