In Western Australia, the Clean Energy Link is framed as a major step forward — unlocking renewable energy zones and supporting the energy transition. But look a little deeper, and important questions emerge:

Who is funding the infrastructure — and who profits from it?

Are we prioritising outcomes, or just asset growth?

Is this genuinely about decentralisation, or simply shifting control?

I recently unpacked these tensions in a long-form piece — reflecting on how state-owned infrastructure, policy narratives, and private capital are interacting in ways that deserve scrutiny.

👉 Read the full post here:

https://citizen-erased.com/clean-energy-link

The goal isn’t to be cynical — it’s to be clear-eyed. We all want a cleaner energy future. But we also need to ensure transparency, accountability, and fairness as we build it.

Would welcome your thoughts.

#energytransition #infrastructure #policy #netzero #transparency #cleanenergy

Author: matt.acton@a2aconsulting.com.au

When we think about energy creation, we might picture a wind turbine spinning in the breeze or solar panels gleaming in the sunlight. But what do all these forms of energy generation have in common? They all ultimately rely on electromagnetic processes. Whether we’re talking about spinning a generator or harnessing photons from the sun, electromagnetism plays a key role in transforming various types of energy into electricity.

In this post, we’ll explore how different forms of energy creation—from fossil fuels to photovoltaics—are all tied to the fundamental principles of electromagnetism.

The Role of Electromagnetic Induction in Energy Creation

One of the most common ways we generate electricity is by spinning turbines, which convert mechanical energy into electrical energy. This is done using a process called electromagnetic induction, discovered by Michael Faraday in 1831. Electromagnetic induction occurs when a magnetic field changes near a conductor (like a coil of wire), inducing a flow of electric current. The generator’s key components include a rotor (the part that spins) and a stator (the stationary part).

No matter the energy source—whether it’s fossil fuels, nuclear energy, wind, water, or geothermal heat—the ultimate goal in these systems is to spin a turbine, which turns the rotor and induces electricity in the stator. Here’s how various energy sources drive the spinning process:

Fossil Fuels (Coal, Oil, and Natural Gas)

In power plants fueled by coal, oil, or natural gas, these fuels are burned to create heat. This heat boils water, turning it into steam, which then spins a turbine. The turbine is connected to a generator, which uses electromagnetic induction to produce electricity.

Nuclear Energy

Nuclear power plants use the heat generated by nuclear fission (the splitting of atomic nuclei) to create steam. This steam drives a turbine, which is connected to a generator. As with fossil fuels, the key to electricity generation here is the spinning turbine that drives electromagnetic induction.

Hydropower

In hydropower plants, the kinetic energy of moving water is harnessed to spin a turbine directly. The force of flowing water turns the turbine blades, which spin the rotor inside a generator to induce electricity.

Wind Energy

Wind turbines capture the kinetic energy of the wind to spin large blades. These blades are connected to a rotor that turns a generator, using the same principle of electromagnetic induction to create electricity.

Geothermal Energy

Geothermal power plants use the heat from the Earth’s core to generate steam, which spins a turbine. The turbine’s motion again drives a generator to produce electricity via electromagnetic induction.

Photovoltaic Cells: Direct Conversion of Electromagnetic Energy

Not all energy generation involves spinning turbines. Solar photovoltaic (PV) cells work in a completely different way but are still tied to electromagnetic principles. Rather than using mechanical movement to generate electricity, PV cells harness electromagnetic radiation from the sun.

Electromagnetic Radiation and the Photovoltaic Effect

Solar PV cells rely on photons, which are particles of light from the sun, to knock electrons loose from atoms in a semiconductor material (usually silicon). This process, known as the photovoltaic effect, creates a flow of electric current directly from sunlight. When photons strike the semiconductor, they excite electrons, giving them enough energy to move through the material and generate electricity.

Unlike turbine-based systems that rely on electromagnetic induction, PV cells convert the sun’s electromagnetic energy directly into electrical energy. This is a completely different form of energy conversion, but it still centers around the principles of electromagnetism, specifically the interaction between light (electromagnetic radiation) and the semiconductor.

Batteries: Electromagnetic Forces in Chemical Energy

Even in cases where we generate electricity from stored chemical energy, such as in batteries, the process involves electromagnetic forces. Inside a battery, chemical reactions occur that create a flow of electrons through a conductor, which is how we harness electricity. The movement of these electrons is governed by the same laws of electromagnetism that apply to other forms of energy generation.

Though batteries don’t involve spinning turbines or the direct use of sunlight, they still rely on the movement of charges (electrons) through a conductor. This movement is driven by electromagnetic forces at the atomic level.

How All Energy Creation is Electromagnetic

Now that we’ve explored various energy sources, it’s clear that electromagnetism is central to all forms of energy generation. Whether energy is produced mechanically (by spinning turbines) or through direct conversion (like with PV cells), it always comes back to the interaction of electromagnetic forces. Let’s summarize:

- Mechanical energy conversion (from fossil fuels, wind, hydro, nuclear, geothermal) relies on electromagnetic induction, where a spinning turbine and generator produce electricity.

- Direct conversion (as in solar photovoltaic cells) uses electromagnetic radiation from sunlight to create an electric current through the photovoltaic effect.

- Even batteries involve the flow of electrons, which is driven by electromagnetic forces.

All of these processes, though different in their methods, ultimately involve the generation or manipulation of electricity through electromagnetic phenomena.

Conclusion

Whether you’re driving through a wind farm or installing solar panels on your roof, you’re interacting with systems that harness the fundamental power of electromagnetism. From the mechanical spinning of turbines to the direct use of sunlight’s energy, electromagnetism lies at the heart of all modern energy creation. It’s a reminder that no matter the source—wind, water, fossil fuels, or the sun—all energy creation is electromagnetic at its core.

By understanding these principles, we gain a deeper appreciation of the systems that power our world and the technologies that convert various forms of energy into the electricity we use every day.

The rise of artificial intelligence (AI) has brought significant changes to various industries, and asset investment planning and business case development are no exceptions. As AI continues to evolve, there is growing concern that it might replace jobs traditionally performed by humans in these fields. However, the reality is more nuanced. While AI has the potential to automate many tasks, the technology’s effectiveness depends on the quality of data inputs and the structure of the systems it operates within. This article explores how AI is impacting asset investment planning and business cases, what is required to make it work effectively, and the ongoing role of human expertise in managing data, asset information, and SCADA (Supervisory Control and Data Acquisition) systems as inputs.

The Potential of AI in Asset Investment Planning

AI offers several advantages in asset investment planning, particularly in areas where large amounts of data need to be analyzed and complex decisions must be made. Some key benefits include:

- Automation of Routine Tasks: AI can handle repetitive tasks such as data entry, basic financial analysis, and report generation, freeing up human resources for more strategic activities.

- Enhanced Predictive Analytics: AI algorithms can analyze historical data to forecast future trends, helping businesses make more informed decisions about asset investments.

- Improved Risk Management: By continuously monitoring various factors that influence asset performance, AI can identify potential risks early and suggest mitigation strategies.

- Optimization of Asset Portfolios: AI can evaluate and optimize asset portfolios based on predefined criteria, ensuring that investments align with the company’s overall strategy.

These capabilities make AI a powerful tool in asset investment planning, but they also raise concerns about job displacement. While some roles may be automated, the transition to AI-driven processes requires a new set of skills and expertise.

The Role of Data Entry and Structure in AI

One of the most critical factors determining AI’s success in asset investment planning is the quality and structure of the data it uses. AI systems rely on vast amounts of data to make accurate predictions and recommendations. However, the adage “garbage in, garbage out” holds true—if the input data is flawed, the AI’s outputs will be unreliable.

To ensure that AI systems function effectively, businesses must focus on:

- Data Integrity: Ensuring that all data entered into AI systems is accurate, complete, and up-to-date. This requires robust data governance practices and regular audits to catch and correct errors.

- Standardization of Data: For AI to process data efficiently, it needs to be standardized across the organization. This means establishing common formats, units of measurement, and data entry protocols.

- Data Integration: AI systems often need to pull data from multiple sources, including enterprise resource planning (ERP) systems, financial databases, and external market data feeds. Ensuring seamless integration between these sources is crucial for accurate AI analysis.

While AI can automate some aspects of data management, human oversight is essential to maintain data quality and structure. This means that jobs in data management are likely to evolve rather than disappear, with a greater focus on ensuring that AI has the right inputs to work with.

Managing Asset Information

In asset investment planning, detailed and accurate asset information is crucial. AI systems can analyze asset performance data, predict maintenance needs, and optimize investment decisions. However, managing asset information is a complex task that involves several key activities:

- Asset Lifecycle Management: Keeping track of an asset from its acquisition to its disposal, including maintenance schedules, performance metrics, and financial data.

- Condition Monitoring: Continuously monitoring the condition of assets using sensors and other technologies to predict when maintenance is needed.

- Data Accuracy: Ensuring that all asset information is accurate and up-to-date, which is critical for AI-driven decision-making.

AI can assist in managing asset information by automating data collection and analysis, but human expertise is still needed to interpret the results and make strategic decisions. For example, while AI can predict when an asset might fail, human engineers are often required to validate these predictions and decide on the best course of action.

The Importance of SCADA Systems

SCADA systems play a vital role in asset investment planning, particularly in industries such as utilities, manufacturing, and transportation. These systems collect real-time data from assets and infrastructure, providing valuable inputs for AI analysis.

However, the integration of SCADA systems with AI requires careful planning and management:

- Data Collection: SCADA systems generate vast amounts of data, which can be overwhelming without proper filtering and processing. AI can help by identifying the most relevant data points for analysis.

- Real-Time Monitoring: AI can analyze SCADA data in real-time, allowing for immediate responses to issues such as equipment failures or safety hazards.

- Predictive Maintenance: By analyzing SCADA data, AI can predict when equipment is likely to fail and recommend maintenance before a breakdown occurs.

While AI can enhance the capabilities of SCADA systems, human operators are still needed to oversee the process and ensure that the AI’s recommendations are implemented correctly. Additionally, the design and maintenance of SCADA systems themselves remain critical tasks that require specialized skills.

The Ongoing Role of Human Expertise

Despite the potential for AI to automate many tasks in asset investment planning and business case development, human expertise remains essential. AI systems are tools that require proper setup, management, and interpretation to be effective. The following areas will continue to require human involvement:

- Strategic Decision-Making: While AI can provide data-driven insights, the final decision on asset investments and business cases will likely remain in the hands of human managers, who can weigh factors such as company culture, market conditions, and ethical considerations.

- Oversight and Validation: AI systems need to be regularly monitored to ensure they are functioning correctly. Human oversight is crucial to catch any errors or biases in the AI’s outputs and to adjust the system as needed.

- Data Management: As mentioned earlier, maintaining data quality and structure is critical for AI to function effectively. This requires ongoing human effort to manage and clean data, ensure standardization, and integrate different data sources.

- SCADA and Asset Information Management: The management of SCADA systems and asset information will continue to be a vital role, requiring both technical expertise and strategic insight.

AI is poised to significantly impact asset investment planning and business cases, automating routine tasks, enhancing predictive analytics, and improving risk management. However, its effectiveness depends on the quality of data inputs, the structure of data management systems, and the integration of SCADA and asset information.

Rather than replacing human jobs entirely, AI is likely to change the nature of work in these fields, with a greater emphasis on data management, system oversight, and strategic decision-making. For businesses to fully realize the benefits of AI, they must invest in the right tools, train their workforce to manage and interpret AI outputs, and ensure that their data is accurate, standardized, and well-integrated.

The future of asset investment planning and business case development will be a collaboration between AI and human expertise, each playing a crucial role in driving better outcomes for businesses.

Distribution automation (DA) refers to the integration of advanced technology into the electrical distribution system to enhance its efficiency, reliability, and flexibility. It involves the use of communication systems, sensors, and control devices to automate the operation of the electrical grid, allowing for real-time monitoring, control, and optimization of the distribution network. The primary goal of DA is to improve service quality, reduce operational costs, and increase the resilience of the electrical distribution system.

Key Components of Distribution Automation

- Smart Meters

- Provide real-time data on energy consumption

- Enable remote reading and two-way communication

- Facilitate dynamic pricing and demand response programs

- Remote Terminal Units (RTUs)

- Collect data from various sensors and devices

- Communicate with central control systems

- Control local equipment based on commands from the control center

- Intelligent Electronic Devices (IEDs)

- Monitor and control electrical parameters

- Provide protection, automation, and monitoring functions

- Enhance grid reliability and efficiency

- Communication Networks

- Ensure seamless data transfer between devices and control centers

- Utilize technologies such as fiber optics, wireless, and power line communication

- Support real-time data exchange and remote control

- Advanced Distribution Management Systems (ADMS)

- Integrate data from various sources for holistic grid management

- Provide tools for outage management, voltage control, and load balancing

- Enhance situational awareness and decision-making capabilities

Benefits of Distribution Automation

- Improved Reliability

- Faster detection and isolation of faults

- Reduced outage durations

- Enhanced fault location and service restoration

- Operational Efficiency

- Lower operational costs through automation

- Reduced need for manual intervention

- Optimized asset utilization and maintenance

- Enhanced Customer Service

- Real-time monitoring and quicker response to issues

- Improved power quality and reliability

- Better customer engagement through detailed usage insights

- Energy Efficiency

- Improved voltage regulation and loss reduction

- Integration of renewable energy sources

- Support for demand response and energy management programs

- Scalability and Flexibility

- Easier integration of new technologies and systems

- Adaptability to changing grid conditions and demands

- Support for distributed generation and microgrids

Applications of Distribution Automation

- Fault Detection, Isolation, and Service Restoration (FDIR)

- Automated detection and isolation of faults

- Minimized outage impact through quick restoration

- Enhanced reliability and reduced downtime

- Volt/VAR Optimization (VVO)

- Optimized voltage levels and reactive power

- Improved energy efficiency and reduced losses

- Better voltage stability and power quality

- Demand Response (DR)

- Real-time management of energy consumption

- Reduced peak demand and associated costs

- Enhanced grid stability and efficiency

- Distributed Energy Resource (DER) Integration

- Seamless integration of solar, wind, and other renewables

- Improved grid stability and reliability

- Support for a cleaner and more sustainable energy mix

- Advanced Metering Infrastructure (AMI)

- Real-time monitoring of energy usage

- Enhanced billing accuracy and customer engagement

- Support for energy-saving programs and dynamic pricing

Challenges in Implementing Distribution Automation

- High Initial Investment

- Significant upfront costs for technology and infrastructure

- Long-term return on investment considerations

- Funding and financial planning challenges

- Cybersecurity Concerns

- Increased risk of cyber-attacks and data breaches

- Need for robust security measures and protocols

- Ongoing management of security threats and vulnerabilities

- Integration with Legacy Systems

- Compatibility issues with existing infrastructure

- Need for phased implementation and transition strategies

- Balancing old and new technologies during the upgrade process

- Regulatory and Policy Hurdles

- Compliance with evolving regulations and standards

- Coordination with government and regulatory bodies

- Navigating policy changes and incentives

- Skill and Knowledge Gaps

- Need for specialized skills and training for personnel

- Keeping pace with rapidly evolving technology

- Managing workforce transition and development

Future Trends in Distribution Automation

- Increased Use of Artificial Intelligence and Machine Learning

- Enhanced predictive maintenance and fault detection

- Improved decision-making through data analytics

- Automation of complex grid management tasks

- Integration of Internet of Things (IoT)

- Greater connectivity and data exchange between devices

- Improved real-time monitoring and control

- Enhanced overall grid intelligence and responsiveness

- Expansion of Renewable Energy Integration

- Greater reliance on distributed energy resources

- Improved management of intermittent renewable sources

- Support for a more sustainable and resilient grid

- Development of Microgrids and Smart Grids

- Enhanced local control and independence

- Improved resilience and reliability at the community level

- Integration of advanced technologies for optimized performance

- Evolution of Grid Management Practices

- Transition to more proactive and predictive management

- Greater emphasis on sustainability and efficiency

- Adoption of holistic and integrated grid management solutions

Distribution automation is revolutionizing the way electrical distribution systems operate, offering numerous benefits such as improved reliability, operational efficiency, and enhanced customer service. While challenges remain in terms of investment, cybersecurity, and integration, the future trends point towards even greater advancements with the use of artificial intelligence, IoT, and renewable energy integration. As the technology continues to evolve,

As the United Kingdom steers toward a sustainable future, the adoption of electric vehicles (EVs) has gained significant traction.

Central to this transition is the widespread availability and accessibility of EV chargers across the country.

In this blog post, we will delve into the technology behind EV chargers, explore their extensive reach, and analyze compelling case studies from prominent players like Tesla, Osprey, and BP Pulse, highlighting the UK’s commitment to green transportation.

EV Charger Technology

EV chargers encompass various types, each offering distinct charging speeds and compatibility.

In the UK, several charger variants are widely used:

- Slow Chargers (up to 3.6 kW): Often found in residential areas, these chargers are ideal for overnight charging and cater to plug-in hybrids or drivers who don’t require rapid charging.

- Fast Chargers (7 kW to 22 kW): These chargers are commonly available in public parking areas, shopping centers, and workplaces. They provide quicker charging times, making them suitable for drivers needing a charge during their daily activities.

- Rapid Chargers (50 kW and above): Located along major highways, rapid chargers offer substantial charging speeds, enabling swift top-ups for EV drivers embarking on long-distance journeys.

Availability of EV Chargers

The UK has made significant strides in expanding the availability of EV chargers, ensuring convenient access across the nation.

According to Zap-Map [4], a leading EV charging platform, there are over 35,000 connectors at more than 13,000 locations throughout the country. These chargers are positioned in diverse public spaces such as motorway service stations, shopping centers, parking lots, and residential areas, offering an extensive charging infrastructure for EV owners.

Case Studies

Tesla Supercharger Network

Spanning the UK, the Tesla Supercharger network comprises high-powered chargers strategically positioned along major travel routes, enabling long-distance travel for Tesla owners. These rapid chargers utilize Tesla’s proprietary technology, offering fast charging speeds and contributing to a seamless charging experience for Tesla drivers.

According to the UK government’s final report on electric vehicle charging market study, Tesla has the largest number of rapid charging devices in the UK [2]. There are currently over 25,000 public charging devices in the UK, with over 3,000 rapid charging devices. The number of public charging devices has increased by 30% since 2019.

Tesla’s Supercharger network is capable of delivering up to 250 kW of power per vehicle. This means that Tesla drivers can charge their vehicles up to 80% in just 40 minutes.

Tesla has opened up its Supercharger network to non-Tesla vehicles in the UK as part of a pilot scheme. The company has opened 15 Supercharger stations with 158 charge points across the UK1.

In addition to the Supercharger network, Tesla also offers Destination Charging in the UK. Destination Charging is a network of charging stations located at hotels, restaurants, and other popular destinations. These charging stations are designed to provide convenient charging options for Tesla drivers while they are away from home.

According to Ofgem’s case study on electric vehicle-to-grid (V2G) charging in the UK, by 2030, there could be almost 11 million EVs on the road. If 50% of these vehicles were V2G enabled, this would open up 22 TWh of flexible EV discharging capacity per year and could provide ~16GW of daily flexible capacity to the grid [3].

Osprey Charging

Osprey Charging, formerly known as Engenie, has emerged as a significant player in the UK’s EV charging market and is one of the fastest-growing electric vehicle (EV) rapid charging networks [10]. With a focus on rapid chargers, Osprey aims to provide reliable and convenient charging solutions. They collaborate with various partners to install chargers across public spaces, retail locations, and parking facilities. Osprey’s chargers support both CHAdeMO and CCS standards, catering to a wide range of EVs, and their user-friendly app facilitates a hassle-free charging experience.

The company has ambitious plans to double the current number of rapid charge points in the UK by 2024 with a £35 million investment commitment from Cube Infrastructure Fund II.

Osprey Charging has already installed rapid chargers at over 100 sites across the UK and plans to expand its network with over 100 Tritium fast chargers across 40 new charging destinations [11][12].

Osprey Charging offers a pay-as-you-go pricing model for its charging points [10]. The cost of charging is based on the amount of energy used and is priced at £0.30 per kWh. Osprey Charging also offers a subscription service called ‘Club Osprey’, which provides members with access to discounted charging rates and other benefits.

BP Pulse

BP Pulse, a subsidiary of BP, operates one of the largest EV charging networks in the UK. Formerly known as BP Chargemaster, they have established a comprehensive infrastructure with a mix of slow, fast, and rapid chargers.

BP Pulse places their chargers at BP petrol stations, retail sites, and public locations, ensuring widespread accessibility. Their network supports multiple charging standards, providing a reliable charging experience for EV drivers across the country.

BP Pulse is the largest public network of electric vehicle charging points in the UK [5]. The company operates more than 5,000 public charge points across the UK, including around 3,200 that are rapid and ultra-fast [6]. BP Pulse is planning to triple the size of its network by 2030 with a £1 billion investment in infrastructure [7].

According to Zap-Map’s survey on public electric vehicle charging networks in the UK, BP Pulse and Charge Your Car (also owned by BP) have been rated among the worst public electric vehicle charging networks in the UK [8].

In terms of statistics, BP Pulse offers more than 8,750 charging points across the UK [6]. The company’s charging points are accessible via either a pay-as-you-go ‘instant access’ scheme or a monthly subscription scheme, with charging points accessed via an RFID card or fob [9]. BP Pulse also offers best on-the-go rates, starting from £0.44kWh

Adoption in the UK

The adoption of EVs in the UK has witnessed remarkable growth, bolstered by the expanding charging infrastructure. According to the Society of Motor Manufacturers and Traders (SMMT), in 2021, battery electric vehicle (BEV) registrations in the UK more than doubled compared to the previous year. This surge in EV adoption is supported by the robust network of chargers, which continues to expand, keeping pace with the increasing demand for electric vehicles.

Additionally, the UK government has played a pivotal role in promoting EV adoption and charger deployment.

Initiatives like the On-street Residential Chargepoint Scheme, Workplace Charging Scheme, and the Rapid Charging Fund have incentivized the installation of EV chargers, creating an environment conducive to sustainable transportation.

Number Plates

The green stripe on UK car number plates is an initiative by the UK government to raise awareness of electric vehicles (EVs) and incentivize motorists to switch to zero-emissions vehicles [13]. The green number plates were introduced in December 2020 as part of the UK Government’s “Road to Zero Emissions” initiative. The green stripe is a thick green bar down the side of the number plate, which distinguishes EVs from other vehicles [13][14].

The green number plates are designed to raise awareness of electric vehicles and incentivize motorists into making the switch to zero-emissions vehicles [13]. The green number plates can only be fitted to cars that produce zero tailpipe emissions, so only pure electric cars can benefit from them [14]. The UK government has also stated that the green number plates could “unlock” incentives from local authorities for EV drivers, such as access to bus lanes and free parking.

Conclusion

The United Kingdom’s commitment to sustainable transportation is evident in the extensive availability and adoption of EV chargers across the country. With prominent players like Tesla, Osprey, and BP Pulse driving innovation and collaboration, the UK’s charging infrastructure is well-positioned to cater to the growing demand for electric vehicles. As technology advances and government support continues, the UK’s journey toward a greener future will accelerate, paving the way for a cleaner and more sustainable transportation ecosystem.

References:

[1] Tesla Supercharger network open to other brands’ EVs | Electric fleet news

[2] Final report – GOV.UK (www.gov.uk)

[3] Case study (UK): Electric vehicle-to-grid (V2G) charging | Ofgem

[4] https://www.zap-map.com/live/

[5] https://network.bppulse.co.uk/

[6] https://www.bppulse.co.uk/

[7] https://www.bp.com/en/global/corporate/news-and-insights/reimagining-energy/electric-vehicles-update.html

[8] BP Pulse among ‘worst’ electric vehicle charge point providers. https://www.fleetnews.co.uk/news/latest-fleet-news/electric-fleet-news/2021/12/13/bp-pulse-among-worst-electric-vehicle-charge-point-providers

[9] https://en.wikipedia.org/wiki/Bp_pulse

[10] https://www.ospreycharging.co.uk/about-us

[11] Over 100 New Tritium Fast Chargers Added to the Osprey Charging Network in the United Kingdom. https://www.businesswire.com/news/home/20211216005008/en/Over-100-New-Tritium-Fast-Chargers-Added-to-the-Osprey-Charging-Network-in-the-United-Kingdom

[12] Over 250 New Tritium Fast Chargers to Be Added to the Osprey Charging Network in the United Kingdom. https://www.globenewswire.com/en/news-release/2022/05/03/2434287/0/en/Over-250-New-Tritium-Fast-Chargers-to-Be-Added-to-the-Osprey-Charging-Network-in-the-United-Kingdom.html

[13] Green number plates for zero emission vehicles. https://www.gov.uk/government/news/green-number-plates-for-zero-emission-vehicles

[14] What you need to know about green number plates. https://www.autotrader.co.uk/content/advice/green-number-plates

[15] Green number plates explained. https://www.carwow.co.uk/blog/green-number-plates-explained

Introduction:

Dreaming of working in the United States? The E3 visa could be your ticket to pursuing professional opportunities in the land of endless possibilities. Designed exclusively for citizens of Australia, the E3 visa offers a streamlined pathway to work legally in the United States. In this blog post, we will explore the key features of the E3 visa, the application process, and its benefits for Australian professionals looking to advance their careers in the USA.

1. Understanding the E3 Visa:The E3 visa was established in 2005 as a result of the United States-Australia Free Trade Agreement. It is a non-immigrant visa category reserved solely for Australian citizens seeking employment in a specialty occupation in the United States. The specialty occupation requirement means that the job should require a specialized body of knowledge and at least a bachelor’s degree or its equivalent.

2. Key Features and Benefits:

a) Job Opportunities: The E3 visa opens up a wide range of employment prospects in the United States. Australian citizens can secure jobs in various industries, including IT, engineering, finance, healthcare, architecture, and many others. This visa offers flexibility and allows for multiple employers during its validity period.

b) Spouse Work Authorization: The E3 visa stands out from other non-immigrant visas as it grants work authorization to the spouse of the primary visa holder. This feature enables dual-career couples to pursue their professional aspirations in the United States simultaneously.

c) Visa Duration and Renewal: The initial validity period of an E3 visa is up to two years, but it can be extended indefinitely in two-year increments. The E3 visa provides an excellent opportunity for Australian professionals to gain valuable work experience and potentially explore permanent residency options in the future.

3. Application Process:

a) Labor Condition Application (LCA): Before applying for the E3 visa, the employer must file a certified Labor Condition Application (LCA) with the U.S. Department of Labor. This process ensures that the employer will provide fair wages and working conditions that do not adversely affect U.S. workers.b) Petition Submission: Once the LCA is certified, the employer can submit a completed Form I-129, Petition for Nonimmigrant Worker, to the United States Citizenship and Immigration Services (USCIS). The petition must include supporting documents such as the certified LCA, a job offer letter, and proof of the applicant’s qualifications.

c) Visa Interview: After approval of the petition, the applicant must schedule a visa interview at the nearest U.S. embassy or consulate. During the interview, the applicant will be required to provide necessary documentation, including a valid passport, visa application forms, photographs, and supporting evidence of their qualifications.

4. Tips for a Successful Application:

a) Thoroughly Prepare Documentation: Compile all necessary documents meticulously, ensuring they are accurate, up-to-date, and well-organized. This includes educational degrees, professional certifications, employment letters, and other supporting evidence of your qualifications.

b) Show Strong Ties to Australia: Demonstrate that you have significant ties to Australia, such as family, property ownership, or long-term career prospects, to establish your intention to return after the visa expires. This will strengthen your case and alleviate concerns about potential immigration intent.

c) Seek Professional Guidance: Consider consulting with an immigration attorney or an experienced visa consultant to ensure you navigate the application process smoothly and maximize your chances of success.

Conclusion:

The E3 visa serves as a remarkable opportunity for Australian professionals to advance their careers in the United States. With its unique features, job flexibility, and extended duration, this visa category provides an excellent pathway to explore new horizons and gain invaluable international experience. By understanding the key aspects of the E3 visa and diligently preparing your application, you can embark on an exciting journey toward working in the USA. So, why not take the first step today and pursue your American dream through the E3 visa?For more information and resources on the E3 visa and the application process, visit the following websites:- United States Department of State: [https://travel.state.gov/content/travel/en/us-visas/employment/temporary-worker-visas.html](https://travel.state.gov/content/travel/en/us-visas/employment/temporary-worker-visas.html)- U.S. Citizenship and Immigration Services (USCIS): [https://www.uscis.gov/working-in-the-united-states/temporary-workers/e-3-certain-specialty-occupation-professionals-from-australia](https://www.uscis.gov/working-in-the-united-states/temporary-workers/e-3-certain-specialty-occupation-professionals-from-australia)- Australian Embassy, Washington DC: [https://usa.embassy.gov.au/](https://usa.embassy.gov.au/)- Fragomen: [https://www.fragomen.com/insights/alerts/e-3-visa-guidance-uscis-new-petition-filing-procedures](https://www.fragomen.com/insights/alerts/e-3-visa-guidance-uscis-new-petition-filing-procedures)Remember to always refer to official government sources and consult with professionals for the most up-to-date and accurate information.

Good luck on your E3 visa journey!

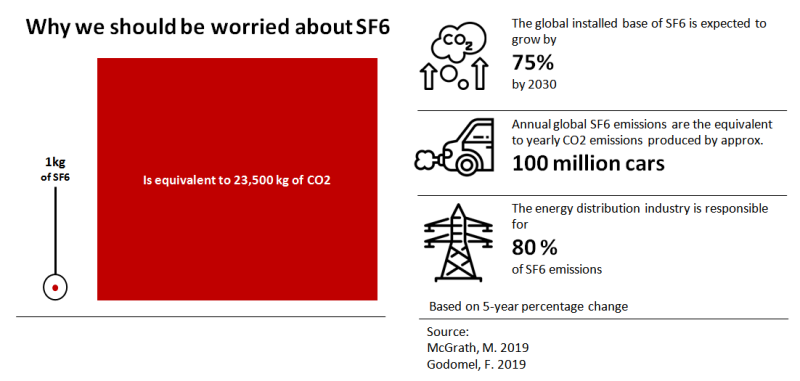

Many electricity Transmission and Distribution utilities use high-voltage electro-mechanical plant and switchgear containing Sulfur Hexafluoride (SF6) synthetic gas.

SF6 is used inside circuit breakers, reclosers, switchgear and wind turbines to extinguish the electrical arc when the contacts inside are separated; enabling the electrical circuit to be broken. The use of SF6 gas allows equipment to be much smaller and more efficient.

Impact of SF6

According to the Intergovernmental Panel on Climate Change, SF6 is the most potent greenhouse gas that it has evaluated, with a global warming potential of 23,900 times that of CO2 when compared over a 100-year period [1 Appendix 1]. All developed jurisdictions require the annual reporting of SF6 usage [9][10][2].

SF6 today contributes less than 1 percent of man made global warming, although is increasing annually [2].

SF6 circuit breakers typically have a combination of static seals (O-rings and gaskets) as well as dynamic seal assemblies. Over time, seals degrade due to environmental conditions and exposure.

The IEC ‘default annual leakage rates’ of SF6 for a single ‘gas insulated switchgear and circuit breaker applications’ is 0.0089 (i.e. less than 1%) [1]. Major manufacturers have demonstrated leakage rates below 0.1% per year, following decades of operational experience and extreme temperature testing [8].

‘Gas insulated switchgear and circuit breaker applications’ have a SF6 capacity ranging from 1.8 kg (for a 22kV Distribution Recloser) to 49.6 kg (for a 500kV substation circuit breaker).

Using leakage rates of 0.1%, and 2019 regional carbon prices [5] this could cost power utilities between $600 to $17k (AUD), or £1k to £35k (GBP) per circuit breaker annually. Large utilities could own hundreds (Transmission) or thousands (Distribution) of SF6 circuit breakers [9] and these costs would accumulate significantly over time.

Condition-Based Maintenance Asset Strategy

SF6 gas levels are typically recorded during routine (e.g. monthly, bi-monthly, quarterly) equipment inspections on-site.

When a trend of lowering SF6 gas pressure is observed, the cause of the leak is subsequently investigated and (hopefully) rectified per the equipment manufacturer’s instructions. Non-evasive ‘laser leak detection’ technologies can help to pinpoint the source of SF6 leaks.

from the Field (Left) to Reporting (Right)

The presence of a ‘high leakage rate alarm’ SCADA alarm may be forwarded digitally to the system operator, via the SCADA system, to trigger a medium/low priority inspection.

from the Field (Left) to Operator (Right)

At the end of life, disposal of the used SF6 gas is either recycled, or disposed by incineration.

Alternatives for SF6 are commercially available for use in electrical switchgear at low-to-medium voltages. Solutions for use at higher-voltages are more challenging, although pilot installations do exist at 145kV.

The technical life of circuit breakers and switchgear is typically around 40 years and the ongoing cost of SF6 will be a factor in planning for replacement.

This condition-based asset strategy leaves scope for SF6 to be leaked in-between routine inspections and for response to be reactive in nature, with associated environmental and financial impacts.

In the meantime, it is prudent to measure and manage SF6 gas usage with a ‘Real-Time’ condition-based maintenance strategy, and offset emissions.

‘Real-Time’ Condition-Based Maintenance Strategy

Substations and Distribution Automation equipment (particularly modern substations utilizing IEC 61850 protocols) have access to a wealth of digital data on the condition and performance of circuit breakers and switchgear.

SF6 gas pressure can be digitally monitored via (e.g. DNP3 digital inputs) alarms for ‘high leakage rate alarm’ and measurements (e.g. DNP3 analog inputs) for ‘leakage rate’; shown below. If needed, a transducer or SF6 monitor can be retrofitted to closed pressure equipment to provide the capability.

However, the Real-Time data available on-site is often aggregated or distilled for forwarding to a central location. This is often due to human or technological constraints such as:

- Limiting the information overload to the personnel administering alarms and measurements; to raise a work request or job request for remedial action

- Bandwidth limiting the volume of data transmitted

- Computational processing power limiting the volume of data collected, interpreted and forwarded

Also, in most cases the SCADA connected equipment requires human intervention (i.e. operator or asset manager) to raise a work request or job request for remedial action i.e. SCADA and/or data historian systems not integrated with Enterprise Resource Planner.

from the Field (Left) to Reporting (Right)

To enable effective analytics and decision-making will often require end-to-end re-configuration or upgrade:

- On-site product relays or controllers

- On-site substation computing such as Remote Terminal Units (RTU), gateways or regional data concentrators

- Head-end Real-Time SCADA systems such as Energy Management System, Distribution Management System

- Data-historian, data warehouse including ETL and reporting capability

- Enterprise Resource Planner (ERP) and/or Asset Management System (AMS)

- New backhaul telecommunications circuits and data center hosting capacity

An alternative, expedited approach is for SF6 monitoring and reporting via a vendor subscription (additional $/month), typically by retrofitting (and powering) the vendor’s SF6 monitor and a 3G/4G cellular modem to each circuit breaker (shown below).

from the Field (Left) to Reporting (Right)

With the new real-time information, SF6 leakage can be detected instantly and earlier than physical inspection and with data analytics unlock capabilities for preventative maintenance. This may involve identifying and reacting early to trends and correlation within different operating environments (e.g. weather, altitude), vendors, products, installation practices or workmanship.

Real-time monitoring may be a cost effective strategy to manage carbon emissions, compared to manual inspections and proactive replacement.

Change for Climate Change

An increasing environmental focus, compliance requirements and carbon markets is expected over the years to come.

Utilities and their partners that are ready and prepared to manage their SF6 emissions will benefit from avoiding the rush and actively managing the brand impact, if/when the legislative change occurs.

Any new environmental obligations and adopted carbon pricing models could provide an exemption to existing, in-service equipment, only applying to new equipment installations; subject to a grandfathered strategy to transition by a certain date (e.g. replace on failure or beyond economic repair with compliant equipment).

Or an approach could be to plant a LOT of trees or actively trade in carbon credit markets.

In most cases there is existing telemetry and operational technology capability to leverage, ask me how to improve your asset management strategy and connect your IT/OT businesses and technologies to extract these benefits and deploy at speed today.

References:

[1] https://www.industry.gov.au/sites/default/files/2020-07/national-greenhouse-accounts-factors-august-2019.pdf

[2] https://www.bbc.com/news/science-environment-49567197#:~:text=Cheap%20and%20non%2Dflammable%2C%20SF6,stations%20in%20towns%20and%20cities.

[3] https://www.clipsal.com/faq/detail?ID=FA226304

[4] https://www.epa.gov/sites/production/files/2016-02/documents/conf00_krondorfer.pdf

[5] https://carbonpricingdashboard.worldbank.org/

[6] https://www.epa.gov/sites/production/files/2016-02/documents/conf06_bessede.pdf

[7] https://1library.net/document/myjd7g2y-alternatives-to-sf-in-hv-circuit-breaker-insulation.html

[8] https://assets.new.siemens.com/siemens/assets/api/uuid:57363d51dd291bd91128dd7665ae64e808f2fdf2/high-voltage-circuit-breakers-portfolio-en.pdf

[9] https://www.aer.gov.au/system/files/PWC%20-%2014.7%20AMP%20High%20Voltage%20Circuit%20Breakers%20-%2028%20February%202018.pdf

[10] https://www.epa.gov/sites/production/files/2017-02/documents/rak_presentation_2017_workshop.pdf

In developing strategies and business cases for utility telecommunications networks, there are 5 considerations in my experience that set the direction and drive the narrative.

Utilities and infrastructure intensive industries (including transportation, energy and mining) currently own and operate a range of wireless technologies to meet the operational requirements for a safe and reliable service.

There are many use cases for wireless voice and data services for utilities including:

- Land Mobile Radio systems providing critical Push-to-Talk communications during catastrophe to a mobile and increasingly connected workforce

- Mesh radio networks providing Smart / Advanced Metering features such as billing information and remote disconnect (and emerging customer ‘black start’ inverter controls)

- Broadcast radio networks for telemetry and SCADA to monitor and remotely control plant and equipment

- Microwave radio providing the back-haul data pipes to bring it all together at a central control/data center.

Often the telecommunications solution is deployed at a point in time by use case, resulting in independent, bespoke networks of proprietary technologies – and a physical library of manuals and instructions!

This private telecommunications infrastructure collection is often complemented with a costly grab bag of mobile data 2G/3G/4G SIM cards from a local carrier for smartphones and mobile computing, vehicle telematics, revenue metering, coverage infill and additional Internet of Things sensors such as equipment monitoring and fault indication.

The Operational Technology applications required to service changing customer needs are evolving, and the demand for mission-critical wireless data continues to increase; whilst needing to maximize shareholder return (i.e. maintaining or reducing expenses, recovering regulated investment).

To aggregate wireless data needs, many utilities are considering their wireless telecommunications strategy and the business case for deploying a private wireless network, such as evaluation the of architectures and technologies including 3GPP standard LTE, LTE-M, Digital Mobile Radio, P25 Phase II or WiSun Alliance mesh.

Below are the top five considerations for a wireless technology that are the most sensitive to the options analysis and the cost model outputs used to develop a compelling business case.

1. Changes to external obligations

There may be an external trigger, either proposed or eventuated, that forces a re-evaluation of the utilities current wireless technology mix. It could be a change to a legal obligation, contract expiry or equipment End of Life announcement. This consideration will likely drive the timing of a wireless network investment.

Wireless communications likely require a frequency assignment to operate, with licensed radio frequencies providing increased certainty and security to the operating environment (compared to unlicensed). The frequency licenses are administered and managed by national agencies such as by the ACMA (Aus), FCC (US) or Ofcom (UK). On occasions, there are changes to the license rules to maximize the wider utilization of the finite (and very valuable) radio spectrum; requiring action by the license holder (such as reconfiguration or equipment replacement) and possibly the radio equipment vendors (such as product redesign).

Examples in the US include the 3.5 GHz CBRS frequency band changes (affecting utilities with IEEE 802.16 WiMax deployments), 900 MHz frequency (affecting utilities with Sensis and Harris OpenSky deployments), 450 MHz re-banding (affecting LMR deployments). Similar changes are anticipated in Australia’s draft Five-year spectrum outlook 2020–24.

Cyber security is not yet a legal obligation for distribution utilities, but if mandated, the rigor of compliance monitoring of data ‘access, audit and authentication’ can be expected to emerge in time.

Electronic component supplier and vendor product road maps would also trigger change, such as the retirement of analog radio products.

2. Increased bandwidth of technology use cases

The total bandwidth requirement for a geographic area (i.e. density) drives frequency spectrum needs which is a significant financial (and technical) consideration.

The total wireless bandwidth required by the utility use cases for a given geographic area is the volume of equipment x size of the data (/second). The geographic area is determined by the operating environment (i.e. terrain, noise) and radio propagation characteristics of the frequency spectrum options.

Volume of equipment

The utility will require targeted telemetry and remote control of plant and equipment. The density of field automation will continue to increase (i.e. switches, valves, indicators), advanced (smart) meters will come online and the connected field workforce will roam between for maintenance and emergency fault response.

Also emerging is data connectivity of behind the meter devices (such as inverters, electric vehicles), and unmanned aerial vehicles (i.e. drones) for field surveys.

Size of the use case data

The use case requirements will inform the size of the data per second. Three key factors are that inform the data size are :

- Payload and number of use cases, such as devices, equipment and data ‘points’

- Resolution and sampling rates, also known as scanning, refresh, polling rates or frames per second

- Whether data encryption is enabled (or not).

Often in collecting the use cases and functional requirements from stakeholders, it is very easy for size of the data to blow out based on these factors. Collecting and critically prioritizing requirements will require an informed discussion to shift:

from “I want all telemetry data now, encrypted”

to “I need these critical read-only data points within 30 seconds of the change of event”.

Based on the frequency spectrum availability, it will likely be a case of prioritizing the use cases within the constrained bandwidth.

3. Reduced unit costs

For mission-critical SCADA applications, a ruggedized modem typically costs $1000 +. Essential features include serial data ports and industrial housing ratings.

An application specific data-radio can be replaced with an application agnostic data modem (even if serial data traffic is encapsulated over IP).

With the benefit of international standards and demand, commodity equipment and components, the cost of field telecommunications user equipment can be significantly reduced(although, recent industry examples with branded modems appear to have not yet realized this financial benefit).

The physical installation can be streamlined (e.g. a field worker can install on site, and technician commission remotely), but the typical labor costs of installing a modern data modem are about the same.

4. Corporate strategy and priorities

The ‘bottom up’ utility telecommunications strategy often calls for limitless wireless data and a cautious migration to the latest technology, with an inferred corporate desire to maintain or reduce capital and operating budgets and employee headcount.

The corporate ‘top down’ assumed priorities will likely be confirmed during approvals, in which scope or schedule will be adjusted; rather than the necessary rethink of the ownership and operating models require to meet the corporates objectives for rapidly evolving data needs and technologies.

For a power distribution utility, the current corporate green/future energy strategies and priorities are increasingly creating an environment for a ‘top down’ telecommunications strategy. This is similar to the top-down utility telecommunications strategies to deploy optic fiber (‘private wired broadband’) during dotcom bubble in the late 1990s. This optic fiber since has proven valuable for the SCADA connectivity of substations and migration to digital tele-protection schemes.

As distributed generation (i.e. solar panels) replaces centralized energy sources (i.e. fossil fuel generation), the transmission and distribution networks are experiencing reduced total electricity demand (although not necessarily daily peak demand). Without a change in pricing structure and/or regulation, the financial result for a utility is reduced tariff revenue and reduced recoverable investment and expenses. Also, whether based on finance, optics or virtue signaling, large investments in fossil fuel or nuclear generation and poles-and-wires infrastructure is increasingly difficult to demonstrate whole of life financial (or carbon?) benefit.

Particularly for private investor-owned utilities, shareholders will require to back-fill deferred or cancelled projects with new, capex-intensive investments to enable the ‘energy transformation’ and ‘grid modernization’ (and avoid stranded assets, and ideally reduce opex).

For a private investor owned utility, the result is a ‘top down’ corporate driver to spend (quickly, and recover costs; OPGW was a favorite and radio spectrum is emerging) on telecommunications and cyber security projects, rather than a ‘bottom up’ pragmatic asset management driver. Although, consideration is to be given as to whether this will create another islanded telecommunications network…

5. Partnership opportunities

There is a drive for a ‘digital economy’, ‘4th industrial revolution’ and ‘rural broadband’ and internet access for everybody.

Utilities hold a number of assets (land, towers, poles, conduit, easements and optic fiber cables) and thousands, if not millions, of potential data subscribers (the use cases and data of #2) that are valuable to the cause. Utilities also typically have a relatively smoother pathway to deploying physical infrastructure through access to routine environmental and land permitting processes and access to cheap credit.

There is the potential to generate additional revenue or (more likely) reduce or offset telecommunications costs (the grab bag referred to above) through collaboration and partnership with neighboring utilities and telecommunications providers.

In many jurisdictions there is a precedent, some power distribution utilities leveraged partnerships to deploy optic fiber (‘private wired broadband’) during the 1990’s, and then some divested the assets to form the backbone of today’s major telecommunications operators. For example, transmission utility NYPA has added the lease of excess bandwidth as a sweetener to their recent wireless business case.

Unless there is a corporate commitment to do so (see #4 above), this potential unregulated revenue is usually a minor consideration in business case development today. Although telecommunications companies and utilities currently (legally have to) work together on structure ‘co-siting’; any revenue derived from hosting radio antennas is a bonus and negligible to an options analysis.

Collaboration and partnerships can be a game changer in developing a (Net Present Value positive) wireless business case, particularly a broadband or Industrial IoT wireless network. Nurturing the deal is a chicken and egg scenario; requiring both corporate strategic direction, executive support, new skillsets and possibly government support for success. The benefits of this collaboration will be extended to the community, such as emergency services, neighboring utilities and telecommunications carriers.

Summary

Utilities require wireless data for prudent asset management, efficient operations, and to position for changing customer behavior.

There are 5 factors to consider to set the direction and develop a prudent utility telecommunications strategy and business case:

- Changes to external obligations

- Increased bandwidth of technology use cases

- Reduced unit costs

- Corporate strategy and priorities

- Partnership opportunities

The understanding of each consideration will help set direction and streamline funding approvals, contracts, project delivery and ongoing operations.

This article has been prepared based on my experience developing utility telecommunications strategies and does not reflect the opinion of my clients.

Please comment or feel free to reach out to me personally to discuss further.

A pipe dream years ago, ‘Private LTE’ is growing in utility circles and a buzz at the #Distributech conference I attended in February 2019.

Utilities have a range of current and emerging use cases and smart grid applications to meet customer service objectives and to remain relevant with new services.

These needs are currently enabled by ‘stacking’ private, proprietary narrowband wireless networks for priority ‘mission critical’ voice and data services, and complementing with commercial telecommunications carrier services.

If all of these services are aggregated, including Push-to-Talk’ voice and smart metering, an upgradable industry-standard wireless broadband solution can meet the needs of tomorrow.

The solution would be designed and operated to meet the reliability and security requirements of the most demanding ‘mission critical’ utility use cases.

However, this is contingent on access to valuable spectrum.

US emergency services with similar ‘mission critical’ reliability and security needs are migrating to ‘FirstNet’ mobile broadband, on federal provision of 700 MHz spectrum.

Investor-owned Utilities (IOU) do not (and in my opinion should not) have such a luxury.

Licensed spectrum can be acquired in competition with telcos; an expensive proposition. As such, the telecommunications industry has progressed technology to manage the precious spectrum asset including roaming, carrier aggregation, network slicing, spectrum arbitrage, prioritization, preemption and Virtual Network Operator (VNO).

Any IOU submission to a regulator for capital recovery for a broadband spectrum and network is likely (and rightly so) to raise red flags.

Forward-thinking utilities can demonstrate prudency and sweeten the deal by bringing telcos millions of subscribers and offsetting the cost by bartering access to their valuable Transmission and Distribution assets: overhead structures, conduit, easements and land.

To summarize, is there a telecommunications platform available to enable the smart grid?

- Yes! Access to a industry-standard wireless, mobile broadband technology can meet all utility requirements

- Yes! The telecommunications solution can be designed to meet stringent ‘mission critical’ reliability and security needs, while sharing valuable spectrum

- Yes! With collaboration, asset arbitrage and/or recycling, broadband solutions and services can be accessed at a lower TCO (compared to today’s suite)

- But no, the ownership model does not need to be private.

And this, for utilities, will be a new world of IT/OT convergence….

Service management rather than asset management!

Please leave a comment, share or connect, I’d be interested in your thoughts.

I recently visited the “PowerBank” community battery energy storage trial in the sprawling residential suburbs of Meadow Springs and Port Kennedy in Perth, Western Australia. Both of these suburbs are ranked in the top 30 suburbs in Western Australia for rooftop solar uptake [1].

WA has embraced Distributed Energy Resources (DER) with one in three households in the South West Integrated System now generating their own renewable power with photovoltaic (PV) solar panels and growing at around 2,000 households a month.

These suburbs have experienced continued growth and is peak demand is encroaching on network capacity limits. To date, capacity constraints have been mitigated through load transfers between distribution substations [2]. Despite the high penetration of PV, the distributed generation contributes minimal demand reduction at time of substation peak load in the early evening (i.e. the “duck curve” 🦆). The 2021 forecast distribution network capacity of the region is shown below [3].

Technological developments in energy storage provide a new utility-grade solution to manage the power distribution and flatten the load profile (i.e. 🦆🔨):

- Peak Shaving: Discharge at times of peak demand to avoid or reduce demand.

- Load Shifting: Shift energy consumption from one point in time to another.

- Demand Response: Discharge instantly in response to signals from a demand response aggregator to alleviate peaks in system load.

- Emergency Backup: Provide intermediate backup power in the event of a supply interruption.

Community energy storage deployment has been green-lighted in WA with the Electricity Industry Amendment Bill 2019 [4] and the release of the Distributed Energy Resources Roadmap [5] in April 2020. The DER Roadmap recommends to install community batteries in locations that are most in need of power balancing.

The PowerBank community battery is an Australian-first trial to integrate bulk solar battery storage into the existing grid that also provides customers with a retail storage option [6].

The local customers don’t have to purchase a behind-the-meter battery, as the local Distribution utility, owns and operates a Tesla branded PowerPack standing proudly in the local park and is featured on their recent advertising campaigns.

Tesla’s PowerPack is commercially available modular battery bank for utility and business energy storage. Each 232 kWh Powerpack is a DC energy storage device containing 16 individual battery pods, a thermal control system and sensors to monitor and report on cell level performance [7].

The PowerBank trial has installed two modules (@ 232 kWh each) and is able to virtually store up to 8 kWh a day of excess generation for 50 trial subscribers (approx 464 / 8).

Although I anticipate this trial will not be operated islanded from the power network, assuming each customers consumption is 2 kWh, these 50 subscribers could potentially ride through an outage up to 5 hours (approx. 464 / 50 / 2).

Standing next to the install there was limited buzzing noise, but as a large white box within a community park, one flagship site has already been a target for vandals 😕.

I’ve been unable to source budgets or project costs for the trial. The Telsla PowerPack costs in the region of USD $172k for a 232 kWh unit [8]. The installation also requires foundations, trenching, low voltage cabling, terminations, protection or fusing, and… reconfiguration of the park’s irrigation system plus graffiti cleanup. I’d anticipate a commissioned site to manage the load profile of 50 customers may cost up to AUD 500k.

Tesla provide a 15-year “no defect” and “energy retention” warranty for the Powerpack. Tesla guarantee that the energy capacity will be at least a percentage (within a range up to 80%) of its nameplate capacity during specified time periods, depending on the product, battery pack size and/or region of installation, subject to use restrictions or kWh throughput caps. Tesla also offer extended warranties, such as 10 or 20 year performance guarantees [9].

The PowerPack utilizes the Tesla’s Microgrid Control System application available across their product range. The application provides a range of alarms and system status parameters required to operate the energy storage system with a shiny user interface [10].

Although it appears limited in Real-Time information for asset management of the battery cells such as cell degradation and capacity. IT/OT convergence is coming for power electronics! In that, rather than the use of an infrastructure asset management framework (such as ISO 55000) and internal operations, the mindset shifts to managing service and performance through warranty and support agreements.

Once (“partnered”) within the Tesla ecosystem, the Microgrid application can be scaled to other energy use cases such as distributed generation and electric vehicles.

The PowerPack provides an Ethernet port for access to Modbus TCP/IP and DNP3 protocols and Rest API [12]. This would provide interface to Tesla’s application or the Distribution utilities Distribution Management System or Distribution Energy Resource Management System (DERMS).

There was no visible antenna mounting to provide strong connectivity. I presume there is a 4G modem providing remote SCADA (and configuration access, firmware updates etc) within the kiosk. The connectivity will be valuable as it also appears there was no SCADA connectivity on the upstream transformer, distribution frame or ring main unit. At both sites there was 2 bars (-113 dBm) of 4G signal using the commercial Telstra mobile network.

If and when the community storage is deployed at scale, and under all operating conditions (incl. black start), combined with electric vehicle charging stations and distribution market operator (or virtual power plant) use cases, the control systems and telecommunications requirements are required to also scale.

Energy storage provides a new solution to manage the load profile where customers are both consuming (demand) and generating (supply). The application of energy storage technology such as a community storage on the low voltage distribution network is helpful to evaluate the solution to reduce energy costs and carbon footprint. This trial will inform technical and economical evaluations, and also facilitate regulatory, governance and operational integration.

References:

[1] https://westernpower.com.au/community/news-opinion/who-really-is-number-1-for-pv-in-perth/

[5] https://www.wa.gov.au/government/distributed-energy-resources-roadmap

[7] https://www.tesla.com/en_AU/powerpack

[8] https://electrek.co/2020/03/31/tesla-powerpack-price-commercial-solar/

[9] https://ir.tesla.com/node/20456/html

[10] https://www.gemenergy.com.au/wp-content/uploads/2017/11/Powerpack_Microgrid-System-Brochure.pdf